-

play_arrow

play_arrow

DukeBox Radio The Voice Of The Wellington Academy

-

play_arrow

play_arrow

Jetstream Episode #15 - Festival of Education Celebration

Pay growth eases back sharply as vacancies drop in record run of falls ONS

Pay growth has eased back at the fastest pace for two years, while vacancies dropped further in the longest run of declines on record, according to official figures.

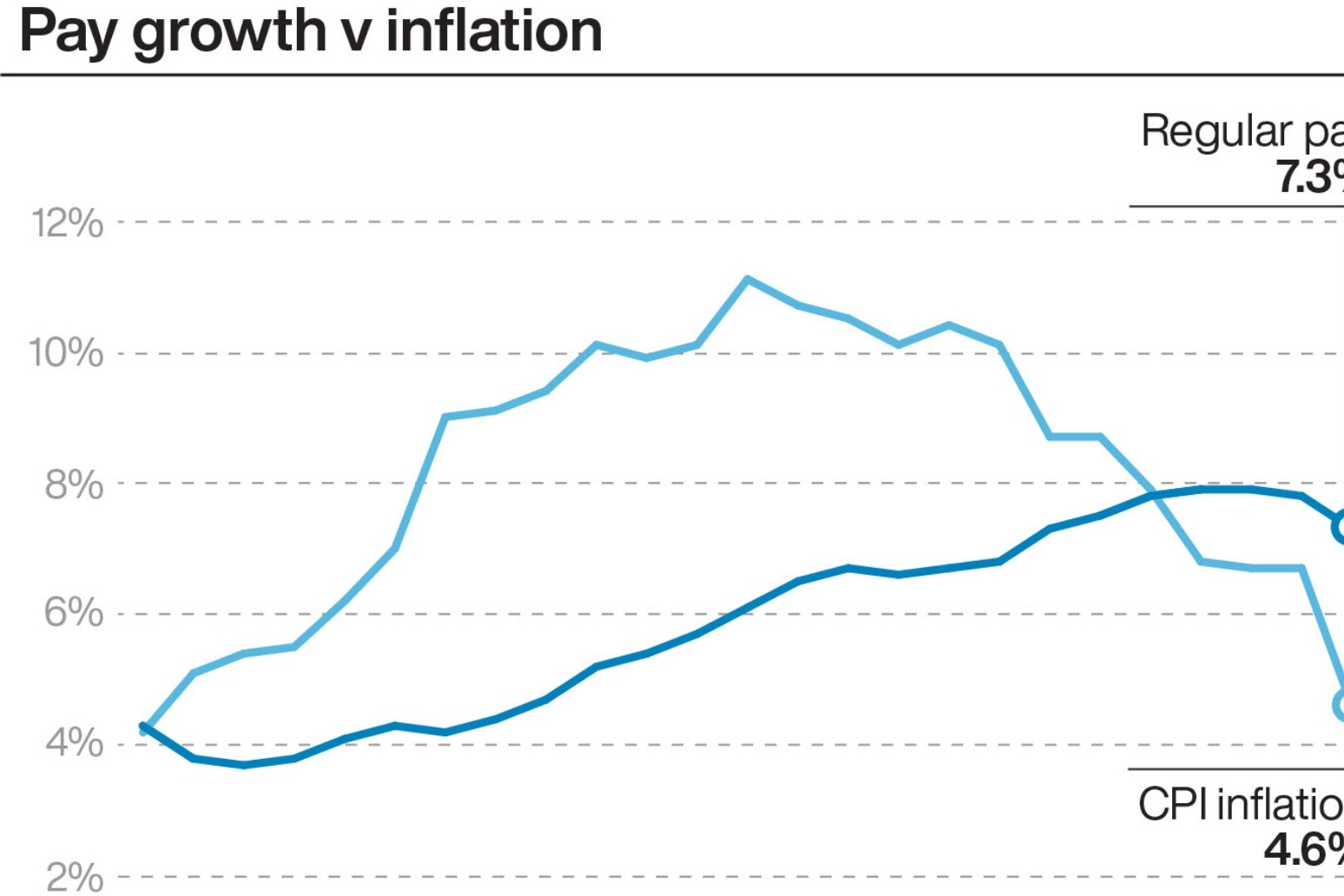

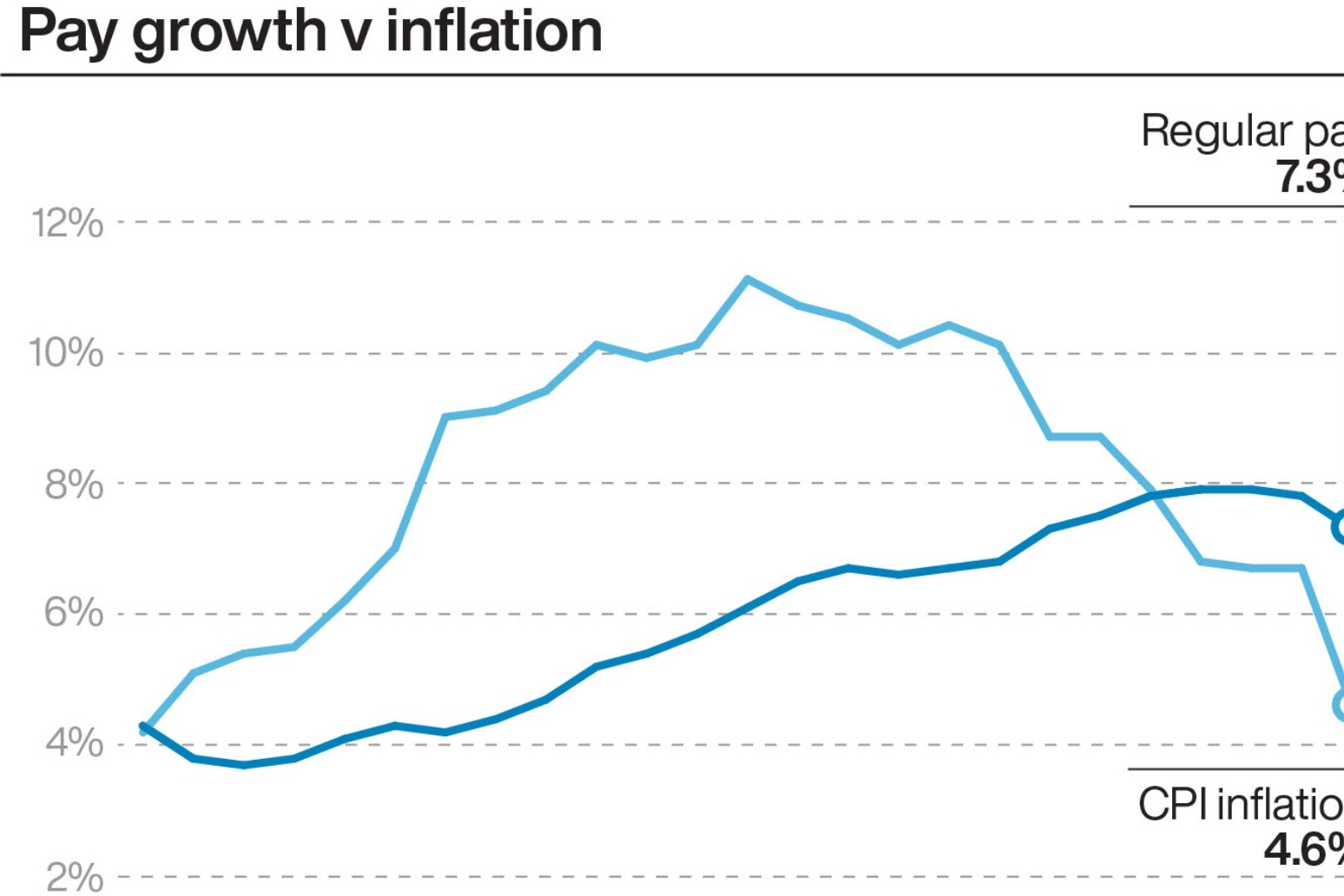

The Office for National Statistics (ONS) said private sector regular earnings, excluding bonuses, rose by 7.3% in the three months to October, down from 7.8% in the previous three months.

This was the steepest fall in earnings growth since the three months November 2021 and marks a further pull back from a record high of 7.9% in the summer.

But despite easing back, pay growth outstripped inflation at the fastest pace for more than two years, up 1.2% after taking Consumer Prices Index inflation (CPI) into account.

In further signs of a weakening UK jobs market, the ONS said the number of vacancies fell for the 17th month in a row, down by 45,000 in the three months to November to 949,000 – the longest period of decline on record.

The rate of unemployment remained unchanged at 4.2% in the three months to October, but more real-time figures estimated the number of workers on UK payrolls fell by 13,000 in November to 30.2 million.

ONS director of economic statistics Darren Morgan said: “Job vacancies fell again. This is now the longest period of decline on record, longer than in the immediate aftermath of the 2008 downturn.

“Nevertheless, the number of vacancies still remains well above its pre-pandemic level.

“While annual growth in earnings remains high in cash terms, there are some signs that wage pressure might be easing overall.

“However, as inflation has been falling more quickly, pay continues to grow in real terms.”

Chancellor Jeremy Hunt said it was “positive to see inflation continue to fall and real wages growing”.

But the data suggests the jobs market is stalling in the face of a more uncertain economic backdrop, with firms not hiking pay as fast, and fewer vacancies there to be filled.

The slowdown in wage growth is seen reinforcing the case for the Bank of England to hold off from raising interest rates further.

Policymakers are widely expected to keep rates unchanged at 5.25% when they next decide on Thursday, with many forecasting the Bank may look to start cutting rates in 2024.

The Bank is watching wage growth intently, with the recent record highs having been a cause for concern in its battle to bring sky-high inflation back down to the 2% target.

Jake Finney, an economist at PwC UK, said: “Signs of labour market cooling will provide some reassurance to the Bank of England Monetary Policy Committee (MPC).

“With no major surprises in the economic data over the past four weeks, rates are likely to remain unchanged.”

Samuel Tombs at Pantheon Macroeconomics said that the unemployment rate is set to “drift higher over the coming months”.

Current jobs data is being collated using extra data sources to estimate the figure due to low responses to the labour force survey.

Mr Tombs said when revised survey data is available from next spring, he expects the rate of unemployment to rise to around 4.8%, “which would further strengthen the case for the MPC to begin to cut Bank Rate at or shortly after its meeting in early May”.

The ONS data also showed there were 131,000 working days lost due to industrial action in October, with 49,000 workers were involved in strikes, though this was the lowest number for four months.

According to the latest figures, the rate of UK employment remained unchanged at 75.7% in the three months to October.

Published: by Radio NewsHub

Written by: admin